Concepts and types of international banks.

DOI:

https://doi.org/10.21564/2225-6555.2014.2.63707Keywords:

international financial institutions, international banking, international banks, universal, regional and subregional international banksAbstract

The article focuses on the analysis of international legal nature of international banks, on the definition of international banks and their types. Highlighting the role of banks as one of the main actors of the international financial system, scientists have not yet given the definition of the term "international banks". In their turn, including the word "bank" in their names, international financial organizations do not give the concept of this legal term in their statutes. We believe that for the definition of the term “international banks” it is necessary, first of all, to determine their international legal nature and their place among the subjects of the international law. In their international legal nature and place among the subjects of the international law international banks are international organizations, and according to their type – international economic and financial organizations. International banks have all the characteristics of international organizations, and along with this they have certain characteristics. The statutes of the international banks determine the purpose of their creation and basic functions. It is the identification and analysis of the purposes of creation of international organizations that is a priority for the definition of international banks and their allocation among other international organizations. Analyzing the statutes of international banks it is possible to distinguish two main directions of the activity of international banks which have led to the establishing of two groups of goals of international banks. The first direction is shared with the main functions, which are inherent in the international economic and financial organizations. This is economic development,

economic cooperation and integration in the region, economic progress and reconstruction, and investments. The other direction is providing of specific financial services which are loans, guarantees or participation in loans, the promotion and encouragement of the development of capital markets, the support of the equilibrium balance of payments, etc. These factors place banks as a special group not only among international economic institutions, but also among international financial ones. International banks have their appropriate organizational structure, independent international rights and obligations, the headquarters; they are legal persons. Thus, on the basis of the analysis of the statutes of the international banks we can arrive at the following conclusion: the international bank is the subject of the international public law established by states and other subjects of the international law in accordance with the international law and on the basis of an international agreement which has an appropriate system of bodies, rights and obligations, independent will, the amount of which is determined by the will of the Statesmembers and provides financial services and resources to the States-members on the conditions established by their constituent documents. Despite similar goals, functions and structure of the standing bodies, international banks can be classified according to several characteristics: the circle of participants which includes universal, regional, and subregional ones; according to the procedure of accepting new members which is open and closed; according to the fields of activities presenting banks with total competence and specialized international banks.

References

1. Витцтум В. Г. Международное право / Вольфганг Граф Витцум. –Москва-Берлин : Инфотропик Медиа, 2011. – 961 с.

Лисовский В. И. Международное торговое и финансовое право / В. И. Лисовский. – М. : Высшая шк., 1974. – 215 с.

Лукашук И. Международное право. Особая часть : учеб. / И. Лукашук. – М. : БЕК, 2001. – 436 с.

Міжнародний банк реконструкції та розвитку (МБРР) [Електронний ресурс]. – Режим доступу : http://web.worldbank.org.

Міжнародна фінансова корпорація (МФК) [Електронний ресурс]. – Режим доступу : http://www.ifc.org.

Міжнародне публічне право : підруч. – К. : Знання, 2012. – 437 с.

Моисеев А. А. Международные кредитно-финансовые организации / А. А. Моисеев. – М. : Изд-во МНИМП, 1999. – 271 с.

Право международных организаций : учеб. / под. ред. А. Х. Абашидзе. – М. : Юрайт, 2014. – 720 с.

Тарасов О. В. Суб’єкт міжнародного права: проблеми сучасної теорії : моногр. / О. В. Тарасов. – Х. : Право, 2014. – 511 с. Теорія і практика правознавства. – Вип. 2 (6) / 2014 До 210-річчя Університету

Тункин Г. И. Теория межународного права / Г. И. Тункин. – М. : Междунар. отношения, 1970. – 511 с.

Тускоз Ж. Міжнародне право/ Ж. Тускоз. – Будапешт-Київ : Артек, 1998. – 401 с.

Угода про заснування Європейського банку реконструкції та розвитку [Електронний ресурс]. – Режим доступу : http://www.ebrd.com.

Угода про заснування Чорноморського банку торгівлі та розвитку [Електронний ресурс]. – Режим доступу : http://www.ebrd.com.

Устав Межгосударственного банка // Моисеев А. А. Международные кредитно- финансовые организации / А. А. Моисеев. – М. : Изд-во МНИМП, 1999. – 271 с.

Шибаева Е. А. Правовые вопросы структуры и деятельности международных организаций / Е. А. Шибаева, М. Поточный. – М. : Изд-во Моск. ун-та, 1988. – 189 с.

Шумилов В. М. Международное економическое право / В. Л. Шумилов. – М. : Юрайт, 2014. – 612 с.

Чубарєв В. Л. Міжнародне економічне право : підруч. / В. Л. Чубарєв. – К. : Юрінком Інтер, 2009. – 367с.

Agreement Establishing the Inter-American Development Bank [Електронний ресурс]. – Режим доступу : http://www.jus.uio.no/.

Agreement Establishing the Asian Development Bank (ADB Charter) [Електронний ресурс]. – Режим доступу : http://www.adb.org/ http://www.afdb.org/fi.

THE AFRICAN DEVELOPMENT BANK [Електронний ресурс]. – Режим доступу : www.afdb.org.

Downloads

How to Cite

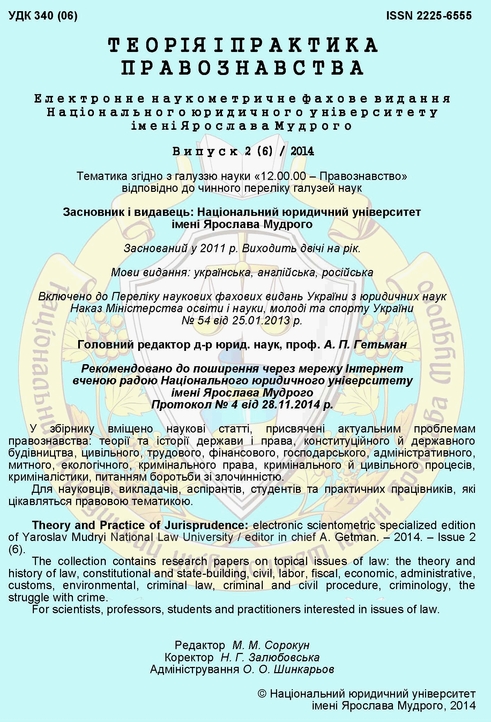

Issue

Section

License

Copyright (c) 2016 Теорія і практика правознавства

This work is licensed under a Creative Commons Attribution 4.0 International License.