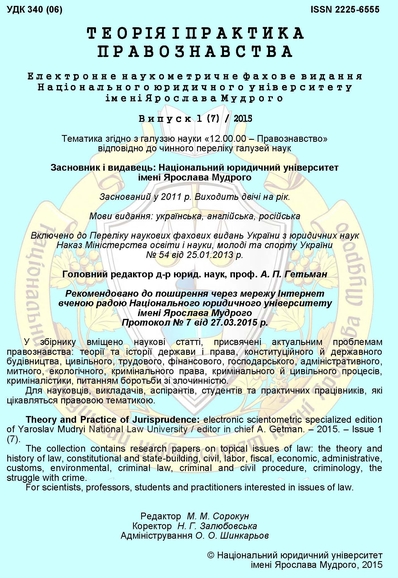

On the problematic issues of determining the object of income tax

DOI:

https://doi.org/10.21564/2225-6555.2015.1.63474Keywords:

taxable object, tax subject, tax source, income tax of the enterprisesAbstract

The objective of the article by Shorokhova Yuliia Serhiivna «On the

problematic issues of determining the object of income tax» is highlighting the

problematic issues in defining corporate income tax. Analyzing scientific literature,

examining the article of the scientists who studied these issues, studying related

regulatory legal acts, all this was done to find the correct answer to the question of

defining the object of income tax.

Corporate income tax is one or even the main of budget-forming taxes, which

has always played an important role in the development and functioning of the state.

Therefore, when considering the corporate income tax it is necessary to examine one

of the key elements of the tax and corporate income tax - the object of taxation and

the object of taxable income. That is what we are doing in this article, because due to

this tax element the formation of revenues to the state treasury takes place.

Upon considering the issue of the object of taxable corporate income tax there

were identified a number of important concepts, “the object of taxation”, “subject of

taxation”, “source of tax”. It is important for formulating a more precise definition of

“the object of taxation” and then “the object of taxable income”.

Art. 22 of the Tax Code of Ukraine (hereinafter the TC of Ukraine) states that

the object of taxation may be property, goods, income (profit) or a part thereof,

turnover from the sale of goods (works, services), transactions on the supply of goods

(works, services) and other objects defined by the tax legislation, to the presence of

which the tax law reefers the emergence of a taxpayer's tax obligation.

The author of the article having examined a large number of sources, concludes

that the science of tax law has different views on the definition of the subject and the

object of taxation, but scientists generally can be divided into two opposing groups.

One of them belives that the object and subject of taxation should not be separated

and the others vice versa see a number of problems and give examples of these

problems, if they are taken as a whole.

Analyzing the experience of outstanding scientists of both ancient and modern

times it becomes clear, making a comparative analysis of the laws of other countries,

we agree with those scientists who focus their attention on the feasibility of

separating these legal categories.

To make a conclusion on the entire material reviewed by us, it should be noted

importantly, having examined the Ukrainian legislation, partly the legislation of some

European countries, having analyzed the works of outstanding scientists, it should be

noted that a large number of scientists who were interested in the issue of “the object

of taxation” made a significant contribution to the science of tax law. Without their

work relating this issue it was not possible develop legal instrumentarium and

provide the correct, substantial and clear definitions in the legislation. From the

analysis of the law is clear that the significant disadvantage of the Tax Code of

Ukraine is the lack of definition of the object of taxable corporate income tax, and

there only the scheme of income calculation.

References

Исаев А. А. Очерк теории и политики налогов / А. А. Исаев. – М. : ЮрИнфор-пресс, 2004. – 269 с.

Озеров И. Х. Основы финансовой науки. – Вып. 1 / И. Х. Озеров. − М. : Типогр. т-ва И. Д. Ситина, 1917. − 624 с.

Ивлиева М. Ф. К понятию налога и объекта налогообложения / М. Ф. Ивлиева // Вестник МГУ. – 1997. – № 3. – Серия 11. – С. 37–40.

Кучерявенко М. П. Податкове право України : підруч. / М. П. Кучерявенко. – Х. : Право, 2012. – 528 c.

Налоговое право : учеб. пособие / под ред. С. Г. Пепеляева. – М. : ИД ФБК-ПРЕСС, 2000. – 496 c.

Химичева Н. И. Финансовое право / Н. И. Химичева. – М. : Норма, 2000. – С. 281.

Золотые страницы финансового права России. – Т. 1. / под ред. А. Н. Козырина. – М. : Статут, 1998. – С. 142.

Кулишер И. М. Очерки финансовой науки / И. М. Кулишер. – Пг. : Наука и школа, 1919. – С. 85.

Смирнов Д. А. Правовые принципы налогообложения имущества в РФ : автореф. дис. … канд. юрид. наук : 12.00.11 / Д. А. Смирнов. – Саратов, 1998. – 34 с.

Брызгалин А. В. Структура (элементы) налога: новое содержание в условиях Налогового кодекса / А. В. Брызгалин // Налоговый вестник. – 2000. – № 4. – С. 19–23.

Финансовое право : учеб. / под ред. О. Н. Горбуновой. – М. : Юристъ, 1996. – 400 с.

Разгильдиева М. Б. Правовое регулирование налогообложения имущества физических лиц : автореф. дис. … канд. юрид. наук : 12.00.11 / М. Б. Разгильдиева. – Саратов, 1998. – 24 с.

Чуркин А. В. Понятие объекта налогообложения и проблемы его определения в законодательстве : дис. ... канд. юрид. наук : 12.00.14 / Алексей Владиславович Чуркин. – М., 2002. – С. 10.

Гуреев В. И. Российское налоговое право / В. И. Гуреев. – М. : Экономика, 1997. – 383 с.

Податковий кодекс України від 02.12.2010 р. № 2755-VI [Електронний ресурс]. – Режим доступу : http://zakon2.rada.gov.ua/laws/show/2755-17.

Налоговый кодекс Российской Федерации от 31.07.1998 г. № 146-ФЗ [Электронний ресурс]. – Режим доступа : http://base.garant.ru/10900200/.

Налоговый кодекс республики Белорусь от 19.12.2002 г. № 166-З VI [Электронний ресурс]. Режим доступа : http://etalonline.by/?type=text®num=Hk0200166#load_text_none_1.

Директива Ради 90/435/ЄЕС від 23 липня 1990 року щодо спільної системи оподаткування, яка застосовується до материнських та дочірніх компаній, які знаходяться в межах юрисдикції різних держав-членів // Офіційний вісник L 225, 20/08/1990 c. 0006-0009.

Downloads

How to Cite

Issue

Section

License

Copyright (c) 2016 Теорія і практика правознавства

This work is licensed under a Creative Commons Attribution 4.0 International License.