Movement of goods through the customs border of Ukraine

DOI:

https://doi.org/10.21564/2225-6555.2014.2.63460Keywords:

movement of goods, customs regimes, customs clearance, customs value, country of originAbstract

Problem setting. The order of cross-border goods and vehicles for commercial use is the basis of the state customs. As a result of the movement of goods in foreign economic entities is subject to certain subjective rights and legal responsibilities. A person who carries out the movement, to pay taxes and fees, return the product for a certain period unchanged (the temporary removal) to keep the goods in a particular state (customs warehouse regime) to carry the goods on certain route (transit mode). There is also entitled to recover VAT on the free use of the goods (in Ukraine or abroad), change the customs regime free of import and export and so on.

Transported goods are not the same status, heterogeneity, specific features. They are moving from the point of view of customs law, an object owned by a specific subject, with the customs value. In many cases, their signs are installed by specialized laws of the various areas of law. Bans and restrictions on the movement established a wide range of laws and regulations (depending on the type of goods subject movement, customs regulations, means and transportation). The list of goods allowed to move, does not exist. Similarly, there is no single list of goods prohibited by the customs. Recent research and publications analysis. The issue of moving goods through the customs border of Ukraine are still scarcely explored and controversial legal science in general and in particular customs law. Of course, the movement of

goods and its components to some extent, been the subject of distribution was the same theoretical studies in the works B.M. Habrichidze, A.V . Grebelnyka, E.V . Dodina, S.V. Kivalova, O.M. Kozyrina, B.A. Kormicha, A.V . Mazura, V. Naumenko, P.V . Pashka, V.V. Prokopenka, D.V. Pryimachenka, K.K. Sandrovskoho, S.S. Tereshchenka, D.S. Tsalinoyi and others. Review of scientific works leads to the conclusion that despite the obvious signs of apparent legislative wording in this area there is still a lack of understanding of many aspects and features of exercise and movement. Positive perception of Ukraine international legal doctrine in customs led establishment of new approaches, some of which are reflected in the Customs Code of 2012 thus moving goods in a transboundary movement requires further thorough research relevant customs and legal regulation. Paper objective. The purpose of the article is to analyze normative legal acts and scientific literature to identify the main components of the movement of goods - customs regimes and customs clearance. In accordance with the designated purpose of the following objectives: analysis of the normative acts that regulate application of customs regimes and customs clearance; clarify the legal status of participants moving; proposals to improve legislation aimed at regulating the movement of goods through the customs border of Ukraine. Paper main body. One of the key places in moving goods through the customs border of Ukraine belongs customs regulations and customs clearance. Customs regimes established exclusively by the Customs Code. With customs regimes carried out state influence on the development of foreign economic relations. A component of the customs regime reflects the customs policy. The current Customs Code of Ukraine (Art. 70) found that in order to apply the law of Ukraine on Civil customs introduced customs regimes: 1) imports (release for free circulation); 2) re-import; 3) exports (final export); 4) re-export; 5) transit; 6) the temporary admission; 7) temporary export; 8) customs warehouse; 9) free customs zone; 10) free trade; 11) inward processing; 12) processing outside the customs

territory; 13) destruction or destruction; 14) failure to state. Custom regime has its own internal structure that is revealed through the contents that is provided requirements and restrictions. Under the terms of the customs regime understood the circumstances that lead to the possibility of room under it for goods and vehicles, restrictions - direct or indirect prohibition to carry with them certain actions and requirements - actions are related to the implementation feasibility of completing the customs regime When moving goods through the customs border of Ukraine is determined by its country of origin. This information is needed to use taxation and non-tariff measures. Under the country of origin of goods is the country in which the goods were fully produced or subjected to sufficient processing in accordance with the criteria set out in MK Ukraine. Due to the existence of differential customs duties (depending on the country of origin) customs tariff is an effective tool in foreign relations. Country of origin of goods is one of the main elements of the regulation of trade flows between countries is essential in the implementation of foreign trade agreements Conclusions of the research. Moving goods through the customs border of Ukraine is the main location, which is based customs. It brings together in a single unit all provisions of the Customs Code. Its components, especially, are the customs regimes, the customs clearance, the customs control, the customs formalities and the risk management. As for components that were considered in this study, it is possible to recognize the following. Customs regimes are the most voluminous institutes of the customs law. Through cross-border, economic operators elect customs regime provided for by the customs legislation and implement its clearance in accordance with established procedures. The choice depends on the particular administrative or fiscal prescription. The features are purpose of moving, origin (Ukrainian or foreign) status of the goods after customs clearance, payment of customs duties and some other features. By approving features and procedure for customs clearance, the legislator establishes rules for movement of goods through the customs border of

Ukraine. These rules are defined conducted customs policy.

References

Гребельник О. П. Митне регулювання зовнішньоекономічної діяльності : підруч. /

О. П. Гребельник. – К. : Центр навчальної літератури, 2005. – 696 с.

Кабаці Б. І. Механизм державного регуляторного впливу на динаміку економічного

зростання / Б. І. Кабаці // Науковий вісник. – 2007. – Вип. 17.2. – С. 165–177.

Кивалов С. В. Митна політика України : підруч. / С. В. Кивалов, Б. А. Кормич. –

Одеса : Юрид. літ., 2001. – 256 с.

Кивалов С. В. Средства осуществления таможенной политики Украины : учеб.

пособие / С. В. Кивалов. – Одесса : Астропринт, 1995. – 256 с.

Козырин А. Н. Таможенные режимы : моногр. / А. Н. Козырин. – М. : Статут, 2000. –

с.

Митний кодекс України від 13.03.2012 р. // Офіц. вісн. України. – 2012. – № 32. – Ст.

Міжнародна конвенція про спрощення та гармонізацію митних процедур (Кіотська

Конвенція) від 18.05.1973 р. [Електронний ресурс]. – Режим доступу :

http://zakon2.rada.gov.ua/laws/show/995_643.

Основи митної справи : навч. посіб. / [П. В. Пашко, В. А. Аргунов, В. П. Батіг та ін.]

; за ред. П. В. Пашка. – 2-ге вид., перероб. і доп. – К. : Т-во «Знання», КОО, 2002. – 318 с.

Податковий кодекс України : Закон України від 02.12.2010 р. № 2755-VI // Відом.

Верхов. Ради України. – 2011. – № 15-16, №17. – С. 112.

Про виконання митних формальностей відповідно до заявленого митного режиму

: наказ Мінфіну України від 31.05.2012 р. № 657 // Офіц. вісн. України. – 2012. – № 80. – Ст.

Про державне регулювання імпорту сільськогосподарської продукції : Закон

України // Відом. Верхов. Ради України. – 1997. – № 44. – Ст. 281.

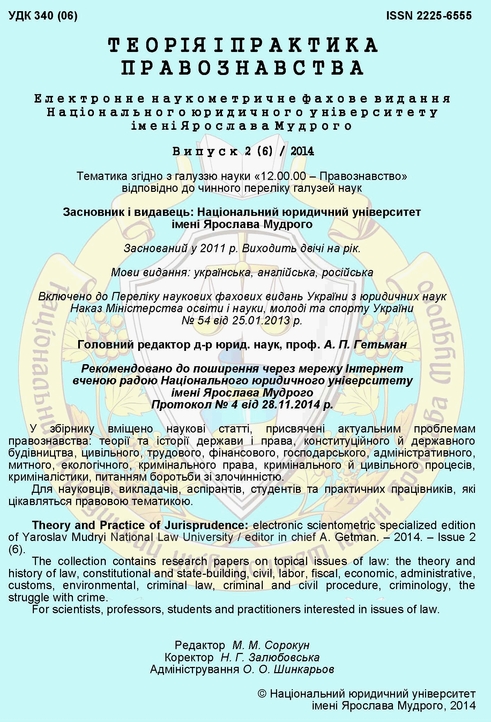

Теорія і практика правознавства. – Вип. 2 (6) / 2014

Про затвердження Порядку виконання митних формальностей при здійсненні

митного оформлення товарів із застосуванням митної декларації на бланку єдиного

адміністративного документа : наказ Мінфіна України від 30.05.2012 р. № 631 // Офіц. вісн.

України. – 2012. – № 64. – Ст. 2627.

Про захист суспільної моралі : Закон України від 20.11.2003 р. // Відом. Верхов.

Ради України. – 2004. – № 14. – Ст. 192.

Про зовнішньоекономічну діяльність : Закон України від 16.04.1991 р. // Відом.

Верхов. Ради України. – 1991. – №29. – Ст. 377.

Про наркотичні засоби, психотропні речовини і прекурсори : Закон України від

02.1995 р. // Відом. Верхов. Ради України. – 1995. – №10. – Ст. 60.

Про основи національної безпеки України : Закон України від 19.06.2003 р. //

Відом. Верхов. Ради України. – 2003. – № 39. – Ст. 351.

Про транзит вантажів : Закон України від 20.10.1999 р. // Відом. Верхов. Ради

України. – 1999. – № 51. – Ст. 446.

Downloads

How to Cite

Issue

Section

License

Copyright (c) 2016 Теорія і практика правознавства

This work is licensed under a Creative Commons Attribution 4.0 International License.